Staff Reports

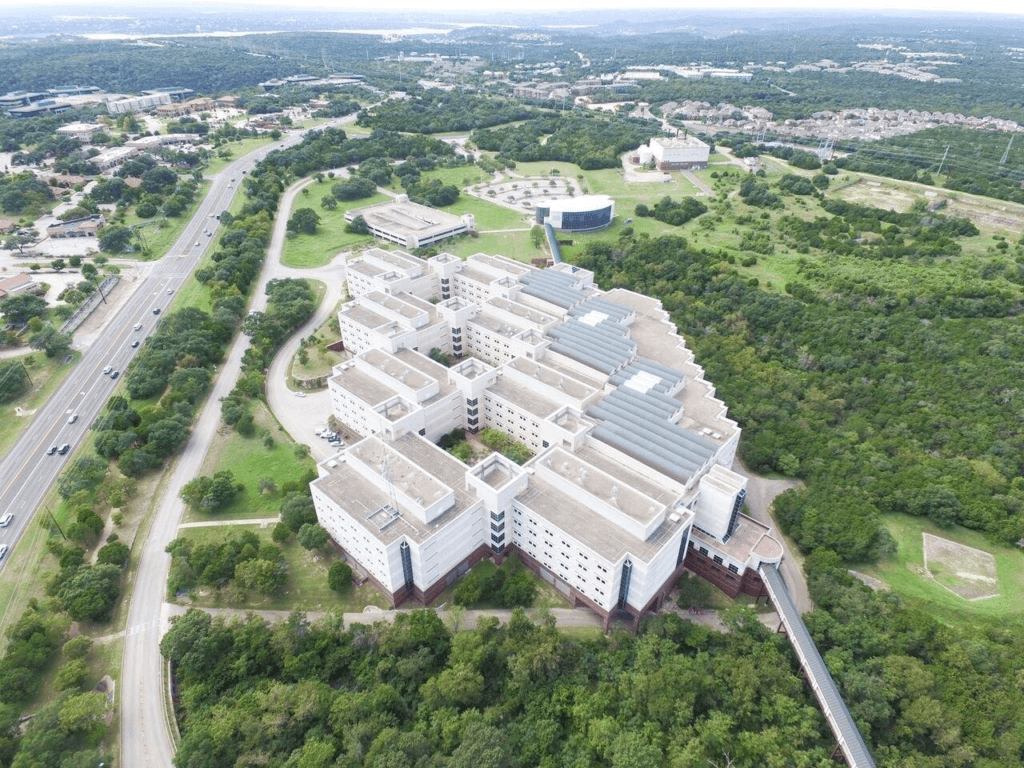

Last week on Nov. 24 a bankruptcy judge granted a motion to remove a stay that shielded the former 3M campus in Four Points from foreclosure. It would have sent the property to a foreclosure auction but this week on Dec. 1 the judge approved a motion for the Silicon Hills Campus LLC — which is controlled by Nate Paul’s World Class Holdings — to come up with a plan for the 156-acre site at RM 2222 and River Place Boulevard.

The Austin American-Statesman and Austin Business Journal both reported that U.S. Bankruptcy Judge Tony Davis last week lifted a stay that potentially would have allowed the property to be sold in a foreclosure auction early next month. But on Dec. 1, Davis “approved a motion by Paul’s attorneys that appears to give Silicon Hills Campus some extra time — until Jan. 31 — to come up with a plan of its own,” the Statesman reported.

The site has been in bankruptcy since January. According to reports it has not won court approval for a plan to make good on a delinquent $64 million promissory note. According to the Statesman, the campus is valued at about $88 million on tax rolls. A court document filed in September 2019, however, says the site is worth more than $200 million.

Lenders to Paul and World Class have attempted to foreclose on properties over the past year. Paul has a lot of properties in Austin. The Statesman says these properties equal “a combined $258 million in what (lenders) say are overdue loans made to more than 24 Texas-based real estate entities controlled by Paul.”

But over the past year Paul filed for Chapter 11 bankruptcy protection on multiple entities in Austin. It is a tactic that used to stall lenders.

On Dec. 1, however, a number of properties owned by Paul and World Class Property Company were acquired during a foreclosure sale in Travis County by a lender owed about $22 million in delinquent debt, according to the Statesman and ABJ.

The Statesman and ABJ have reported that Paul filed for bankruptcy in November 2019 on four entities that own the properties — named 900 Cesar Chavez LLC, 905 Cesar Chavez LLC, 5th and Red River LLC and 7400 South Congress LLC. “But after a year without a viable plan to make good on the delinquent debt, the automatic stay from bankruptcy court that prevented foreclosure was lifted last month, enabling this week’s auction to take place,” the Statesman reported.

ATX Lender 5 was the lender to all four listed properties and was the sole bidder this week. Reports state that ATX Lender won the properties for $17.8 million, although no money changed hands because the lender was owed more, the Statesman reported.

Paul’s attorney, Mark Taylor, claimed the sale was invalid and vows to take steps to pursue appropriate relief, the Statesman said.

Jonathan Pelayo, an attorney for ATX Lender 5, said the sale took place properly and in accordance to Texas law, the Statesman reported. The Paul-controlled entities “were given more than a year (after filing bankruptcy) to reorganize, sell their properties, or refinance their debt,” Pelayo said in the Statesman report.

From the Dec. 1 sale the Statesman reported that the combined properties are valued at about $22.8 million on Travis County tax rolls, but their market value is likely between $42.5 million to nearly $60 million, according to court proceedings.