By LYNETTE HAALAND, Four Points News

The number of homes sold in 2022 was down in Four Points – River Place, Steiner Ranch, Westminster Glen, Comanche Trail and Grandview – but the median sales price went up compared to 2021.

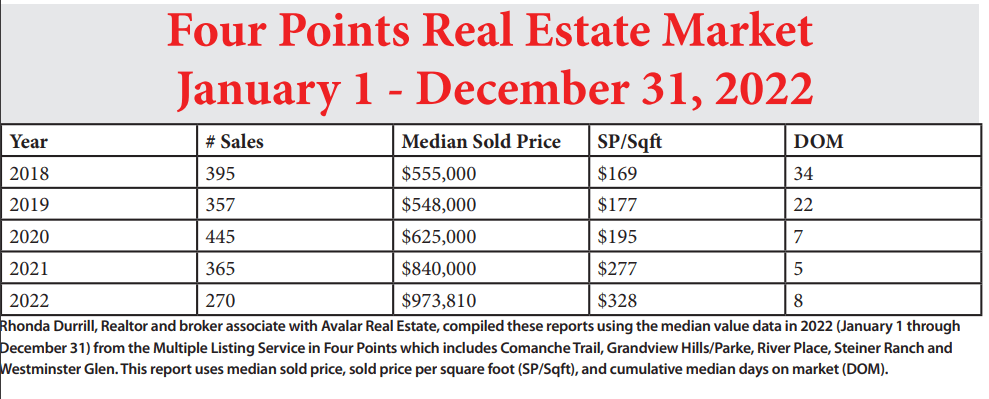

Collectively home sales in the Four Points area dropped 26% to 270 in the 12 months of 2022 compared to 365 sales in 2021. The median sold price in Four Points was up nearly 14% to $973,810 in 2022 compared to $840,000 in 2021.

The Four Points real estate market has seen a little dip since it peaked in the middle of 2022.

“The first half of 2022 saw such a shortage of home supply that the prices temporarily skyrocketed. As more inventory hit the market, we saw price normalization begin around mid-2022 which led us to end the year slightly lower,” said Rhonda Durrill, Realtor and broker associate with Avalar Real Estate.

“This slowdown was also largely fueled by the unprecedented rise in interest rates,” Durrill said. “But, in perspective, prices are still at incredibly high numbers and we still have an inventory shortage. For reference, 2023 began with 38 homes for sale in all of Four Points, as opposed to only nine homes a year ago.”

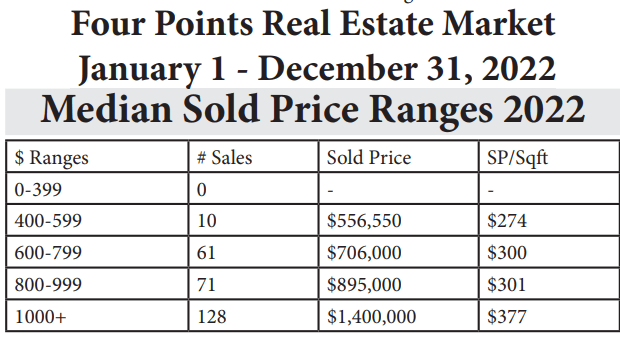

Statistics show that 128 homes sold for a median sales price of $1,400,000 in the Four Points area in 2022.

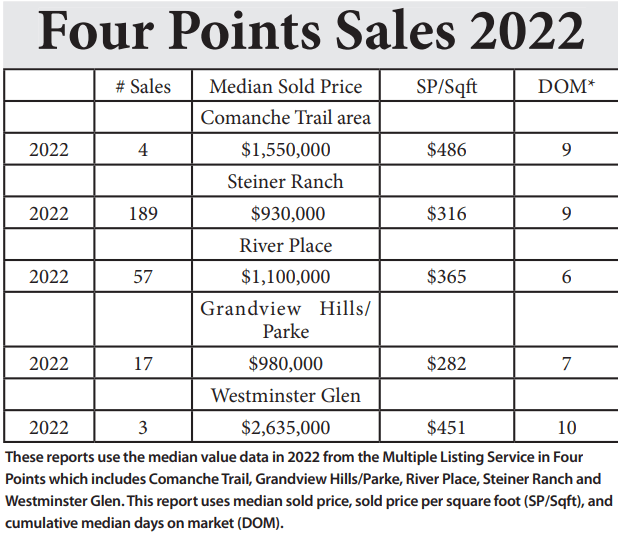

In Steiner Ranch, 189 homes sold in 2022 for a median sold price of $930,000 and in the Grandview Hills area, 17 homes sold for $980,000. In River Place, 57 homes sold for a median sold price of $1.1 million and the Comanche Trail area for $1.55 million in 2022. Three Westminster Glen homes sold for a median sold price of $2,635,000 million.

The Four Points community reflects similar trends going on in the city of Austin and Travis County.

Home sales in the city of Austin decreased 25% to 10,014 sales in 2022. The median sales price for residential homes rose 10% year over year to $590,000 in 2022, an all-time annual record, according to the Austin Board of Realtors Year-End Central Texas Housing Market Report.

In Travis County during 2022, residential home sales decreased nearly 24% to 15,705 sales. The median price for residential homes increased nearly 11% year over year to $575,000.

Austin-Round Rock

“After two years of unprecedented demand, activity and price increases, our housing market began to stabilize in 2022,” said Ashley Jackson, 2023 Austin Board of Realtors president. “Signs point to that trend continuing in 2023 even as interest rates fluctuate, so buyers need to date the rate and marry the house.”

In 2022, bidding wars have subdued as homes on average sold for only less than the original listing price in the greater Austin-Round Rock Metropolitan Statistical Area.

The median price for a home in 2022 set a new annual record of $503,000 in the Austin-Round Rock MSA, according to the ABoR Year-End Central Texas Housing Market Report.

Despite this record, the housing market continued shifting towards buyers as home sales declined 18% to 33,547 homes sold last year.

In 2022, the median price in the MSA rose 11% to $503,000. Sales dollar volume dipped 9.8% to yield a $21 billion impact on the Austin-area economy.

“It is important to remember that we still have a desirable and sought-after market, it is just that now we are seeing our market return to a more normal level of high demand and activity than what we experienced in the years leading up to the COVID pandemic and subsequent boom in our market,” Jackson said.

Inventory

Mark Sprague, state director of information capital for Independence Title, pointed out that economic factors, including increasing construction costs, supply chain and labor issues that could take years to return to normal, could cause inventory to fall in the coming year.

“Even with the inventory gains made in 2022, our region still needs more housing,” Sprague said. “This need could be exacerbated as builders and developers continue to recover after overextending themselves nationally and increasing interest rates lessen people’s buying power. We could see 15-20% less inventory in 2023 as builders scale back their housing starts.”

Affordability will continue to be a major issue in the year ahead, particularly as interest rates impact people’s budgets and companies continue to create jobs across the region.

“Every time interest rates increase buyers lose 12% of their purchasing power. By this summer, if rates increase by one 1.5 basis points as expected, buyers will have 72% less buying power than they did at the beginning of 2022,” Sprague said.

He added that with Austin’s unique attraction as a magnet for job creation, the area should continue to expect employment growth for several years to come, which is positive. However, when combined with expected lower levels of inventory and higher interest rates, affordability concerns will continue to be a factor in real estate transactions at the micro and macro levels, according to Sprague.

Durrill said that spring will tell the story of what the 2023 year will be like. Specifically in Four Points, “inventory has recovered slightly, but the area still has critically low levels.”

This problem could get worse, in Durrill’s observation, as potential sellers who normally look to stay in the area but upsize or downsize, stay where they are due primarily to high interest rates and property taxes.

She adds that this scenario could continue to make the area housing shortage worse.

Normally at this time of year, she gets calls from clients who live in the area who are thinking about moving either out of the Four Points area or within the community. But she is receiving very few of those calls this year. Durill is hearing more from clients moving out of Austin due to work or family matters.

“Without those homes, I am afraid we will continue to see critically low inventory,” Durrill added.

ABoR’s Jackson also has concerns about the low inventory.

“Now more than ever is the time for local elected officials to prioritize housing and take bold actions to help increase our region’s housing stock,” Jackson said. “Communities across Central Texas must come together to meet the challenge of housing our rapidly growing population by collectively finding ways to increase the abundance and variety of housing.”